It's iterative, not an event.

It's iterative, not an event.

Financial statement

Analysis of Income & Expense, Working Capital & Net Worth

Learn to analyze cash position and contracts in transit, accounts receivable aging; 30-60, 60-90, and over 90 days. Review new and used vehicles 30+ days, and total inventories including parts. Review other and total current assets. Review accounts and creditor payables, notes payable including flooring, lease/rental vehicles, current portion of long-term debt, accrued liabilities, and total current liabilities. Manage Net Working Capital with review of benchmarks and objectives for customer & warranty receivables, new & used vehicle and parts inventories. Analyze income from operations, net earnings and Total Net worth. Analyze total dealership sales and gross, F&I and sales PRVS, total operating income, total variable selling expense, total personnel expense, total semi-fixed expense, rent and rent equivalent, total expenses and operating profit before tax. Review same categories for new and used vehicle sales, service and parts. Analyze Financial statement monthly and YTD Gross Profit Analysis with vehicle sold-units, sales dollars, gross profit, and incentives earned. Analyze monthly and YTD sales, gross profits, gross profit % of sales for customer labor, accelerated service, warranty, internal, accessories, Sublet, and body shop for parts and service departments. Analyze monthly and annual dealership & benchmark reports of Return on Gross, Return on Sales, Net Cash Position, Return on Investment, Fixed Overhead Coverage (service/parts absorption), Parts & Accessories Obsolescence and Inventory Turns.

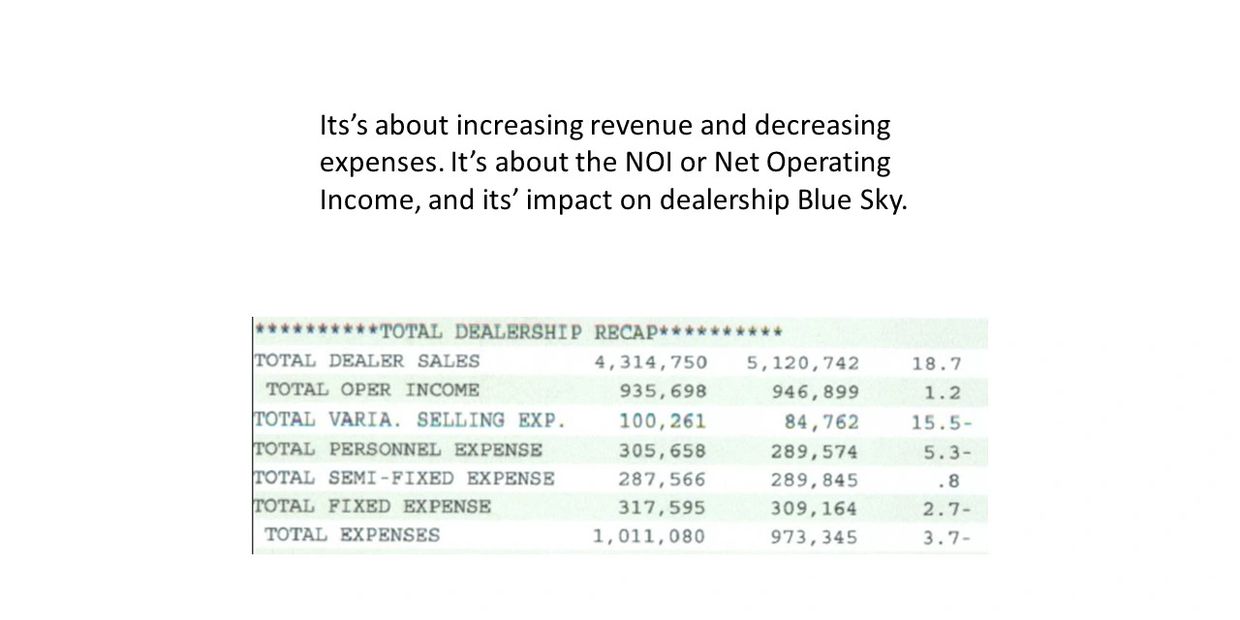

Its’s about increasing revenue and decreasing expenses. It’s about NOI or Net Operating Income and its’ impact on dealership Blue Sky.